The latest updated payment slip form issued by the Ministry of Finance

The payment slip form is one of the most frequently used forms in the daily work of accountants. Although it is very familiar to the accountants who have worked for many years, for those who are new to working or studying in school, you can refer to the payment slip sample introduced below.

1. What is a payment slip? Does the payment slip need to be stamped?

🔅 When having to spend money to solve a certain job, businesses and units will need to use the payment slip form to determine the actual cash or foreign currency disbursements, then make a voucher for the cashier to export money as well as record it in the bookkeepings.

🔅 Therefore, the payment slip is considered an important voucher to manage the expenditure of the enterprise, this voucher will be prepared by the accountant of the enterprise or the unit.

🔅 Pay slips are often used in cases of paying for activities:

◾ Purchase raw materials, goods and services for suppliers

◾ Output cash fund to deposit in the bank

◾ Expenses for cash disbursement to pay short-term or long-term loans

◾ Payment of cash fund for the payment of taxes

◾ Paying salary, spending investment

◾ Paying cash funds to deposit, etc.

🔅 According to current regulations, when making a payment slip, it is necessary to have the signatures of the maker, the payee, the accountant, the treasurer, the head and put a round seal directly if the head signs it, if the head is absent, then put a hanging seal.

2. Details of payment slip forms

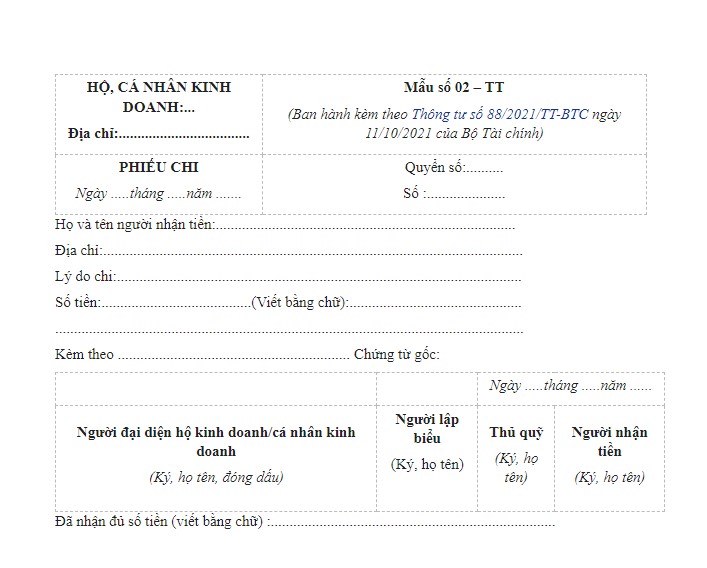

✔️ Payment slip form according to Circular 88/2021/TT-BTC

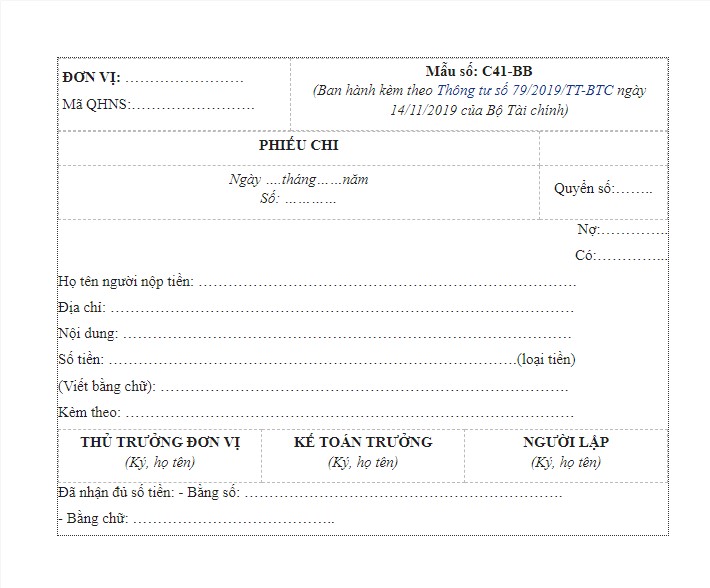

✔️ Payment slip form according to Circular 79/2019/TT-BTC

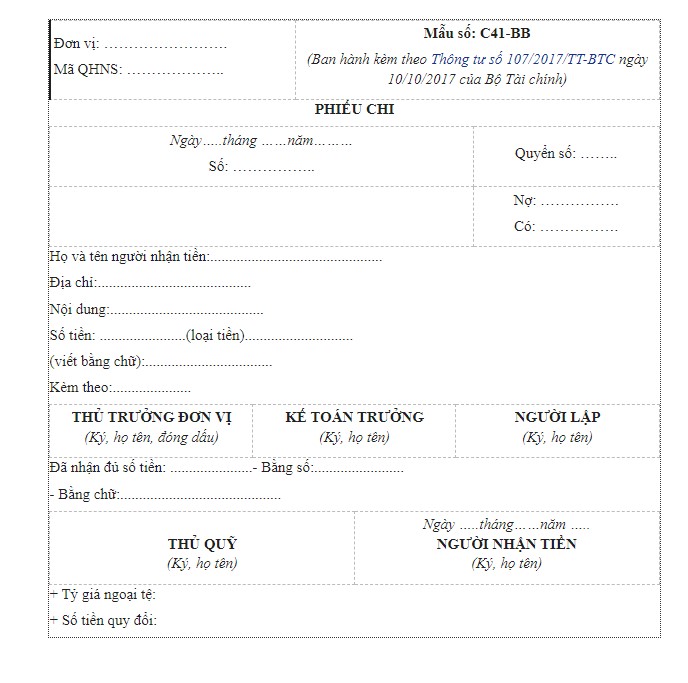

✔️ Payment slip form according to Circular 107/2017/TT-BTC

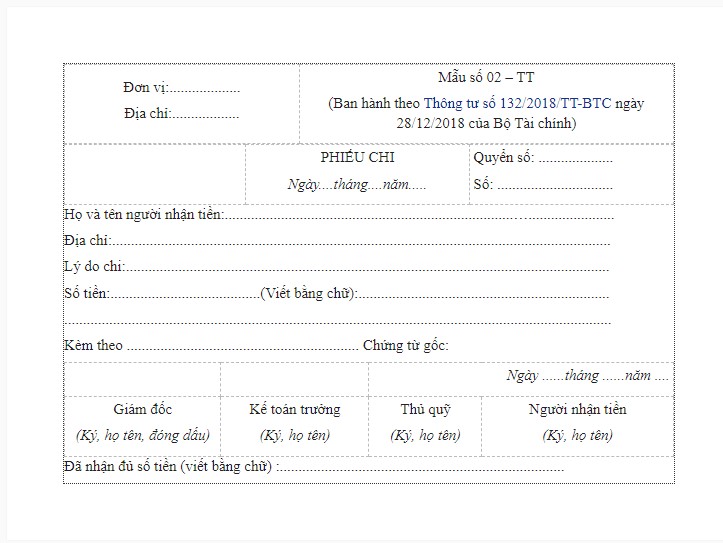

✔️ Payment slip form according to Circular 132/2018/TT-BTC

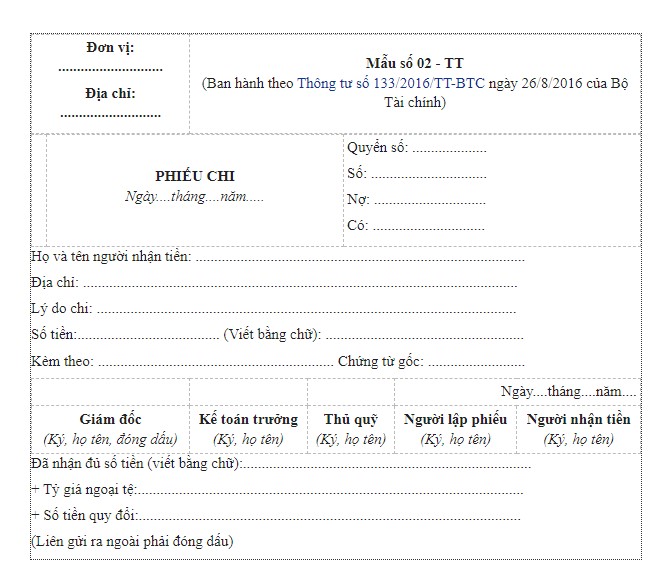

✔️ Payment slip form according to Circular 133/2016/TT-BTC

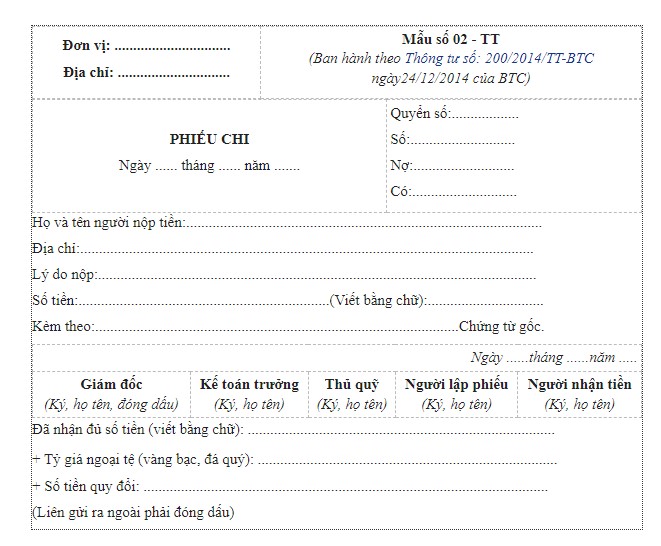

✔️ Payment slip form according to Circular 200/2014/TT-BTC

3. Instructions on how to write in the Payment slip form

🔗 Specify the name and address of the unit in the upper left corner of the payment slip;

🔗 When making a payment slip, the number of sheet must be clearly stated and the date, month and year of making the slip;

🔗 Payment slips need to be bound in books, each book must have the number of books and the number of each payment slip;

🔗 The line "Full name of the payee": Specify the full name of the payee;

🔗 The "Address" line: Specify the payee's address, the work unit of the payee;

🔗 The line “Reason for payment”: Specify the content of payment: February salary payment; buy a desktop computer…

🔗 The line “Amount” must be written in both numbers and words to avoid corrections;

🔗 Line "Attached": Enter the number of original documents attached. Please write in detail the name of each type of attached document.

➡️ The payment slip is made in 3 copies, submitted to the chief accountant and director for signature, then the cashier releases the fund.

➡️ After receiving the full amount, the payee clearly states the amount received, then signs and writes his/her full name on the slip.

➡️ Copy 01 is kept at the place where the slip is made, the two treasurers are used to record the cash book and transferred to the accountant for entry into the accounting book, and the third copy is given to the recipient.

(If using the payment slip form 02 copies, 01 copy is given to the recipient, 01 joint enterprise keeps).

Note:

◾ Payment slips must be bound in volumes, in each payment slip, the number of books and the number of each payment slip must be recorded.

◾ Number of payment slips that must be entered continuously in an accounting period.

◾ Each payment slip must clearly state the date, month, year of making the payment, day, month and year of payment. The line "Amount" is written in numbers in digits, specifying whether the unit is VND or USD.

◾ The payment slip is made in 3 copies and only after having enough signatures of the maker, chief accountant, director, and treasurer can the fund be released.

◾ After receiving the full amount, the recipient must write down the received amount by signature and full name on the payment slip. Note that if it is a foreign currency payment, the exchange rate and price must be specified at the time of fund disbursement to calculate the total amount in units of the recorded currency.

◾ These payment voucher templates are available for sale in pre-printed copies that can be used.

Above are the payment slip samples issued by the Ministry of Finance, Readers who still have questions, can contact Hotline: 0975480868.

TASCO – THE HIGHEST RESPONSIBLE TAX AGENT OF EVERY SERVICE

Hotline: 0854862446 - 0975480868 (zalo)

Website: https://dailythuetasco.com or https://dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Address: 103/15 Nguyen Thi Thap, Tan Phu Ward, District 7, HCMC

Fanpage: https://www.facebook.com/DAILYTHUETASCO

TASCO - GIVE TRUST- GET VALUE

main.comment_read_more