Tax policy and accounting news

15/06/2024 431 Views

When paying PIT, taxpayers are usually concerned about the family deduction for dependents. So if the wife is a homemaker taking care of the family with no income, is the husband entitled to a family deduction? Together with Tasco Tax Consulting Services Co., Ltd. learn about this issue through the article "Does a wife without income get a family deduction"

14/06/2024 388 Views

The business of buying and selling on online platforms is increasingly popular, opening up opportunities for many people. However, one of the things to consider when doing business is tax compliance. So does online business have to pay PIT with Tasco find out more through the article below!!

14/06/2024 486 Views

Personal income tax (PIT) is a compulsory tax that each individual with income must pay to the State. The payment of PIT contributes to ensuring social justice and revenue sources for the state budget. However, there are still some cases where PIT is not payable. In the article below, Tasco shares with you the article "Who does not have to pay personal income tax in 2024"

11/06/2024 389 Views

❓Are you facing any of these difficulties below ❓

31/05/2024 534 Views

To ensure the interests of enterprises when calculating tax: When calculating income subject to CIT, accountants need to determine the deductible and non-deductible expenses to ensure the correct tax amount. Below are the deductible expenses when calculating CIT.

31/05/2024 367 Views

PIT finalization authorization is a taxpayer's permission for an individual or another organization to perform PIT finalization obligations on behalf of a taxpayer. So what are the conditions for authorizing PIT finalization? Join Tasco Tax Consulting Services Co., Ltd. to find out details through the article below.

09/01/2023 1777 Views

In the joyful atmosphere of the first days of the new year, to have a favorable start and promise success, here are the tasks that your business needs to do in the first days of the year without missing out in 2023. Let's find out with Tasco what those jobs are.

06/01/2023 1910 Views

Know the difficulties of enterprises in making financial statements or in the process of tax finalization. Tasco has launched year-end bookkeeping cleaning service to optimize for all small, medium and micro businesses. Help businesses check and review all old accounting documents or make vouchers and explanations according to tax paid financial statements...

05/01/2023 1744 Views

Business establishment service in 2023 is a service of consulting, supporting and acting on behalf of entrepreneurs on legal issues, procedures for setting up a company, documents to prepare for business establishment. Entrepreneurs only need to provide information and relevant documents, the rest will be done by TASCO experts.

04/01/2023 3680 Views

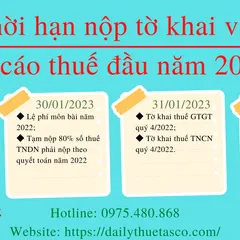

The end of the calendar year is always a time when the tax accounting department at any business is very busy. When having to prepare quarterly tax reports, financial statements, and annual finalization. That makes many customers still not sure whether the time to submit the tax report for the fourth quarter of 2022 is still under the Tax Administration Law or is extended. This article will help customers understand the time to submit tax returns and reports in early 2023.

03/01/2023 2850 Views

From February 1, 2022, the value-added tax (VAT) for groups of goods and services being applied at the tax rate of 10% will be reduced to 8%. Entering 2023, this tax rate has some changes, this article by Tasco will help customers understand the VAT rate in 2023.

21/12/2022 2211 Views

For accountants, the period before the end of the financial year is an extremely busy time with many important financial and accounting operations. In order to have a more favorable start in the new year, as well as avoid the risks of penalties as prescribed by law, this article by Tasco will summarize the things that accountants need to do before the end of the financial year.

12/12/2022 1428 Views

In order to maintain smooth and legal business operations, most businesses need to build themselves a professional tax accounting system from the very beginning. For small and medium-sized enterprises, and startups that have just come into operation, this is a great difficulty. Tax agent TASCO is committed to providing customers with tax accounting services with the highest quality and efficiency, with maximum cost savings for businesses.

07/12/2022 1589 Views

With the desire to assist customers, and limit the risks of tax and tax accounting in the process of doing business, Tax Agent TASCO offers an optimal solution: "A package of tax declaration services for businesses. ”, in order to maximize the accounting work for the unit and minimize tax worries, limit errors leading to penalties due to violations of current tax regulations in the business.

06/12/2022 1774 Views

Do you have a vacant piece of land and need to rent it out to earn extra income? Or do you have an empty house that you need to rent out to earn extra income? But you don't know the tax regulations? What taxes need to be paid? This article by TASCO will answer all your questions about taxes to be paid when individuals lease land and properties.

30/11/2022 1454 Views

With the desire to assist customers, and limit the risks of tax and tax accounting in the process of doing business, Tax Agent TASCO offers an optimal solution: "A package of tax declaration services for businesses. ”, in order to maximize the accounting work for the unit and minimize tax worries, limit errors leading to penalties due to violations of current tax regulations in the business.

30/11/2022 1547 Views

Accounting has always been one of the hot industries and recruitment demand has never decreased, this job requires a lot of experience and skills, but the working capacity of accounting graduates at universities is not high due to the environment. theory-heavy school. Knowing this increasing demand for accounting education, TASCO has launched a practical general accounting training service.

25/11/2022 1435 Views

After completing the business registration process of a new business, the initial tax declaration is a mandatory procedure that any company must perform in order for the unit to operate correctly. determined. How important is the initial tax registration procedure, what documents are included, and when is the deadline for submission... Tax agents TASCO will provide detailed instructions on issues related to the original tax return. in the article below.

25/11/2022 1521 Views

Since the introduction of personal income tax, individuals with high incomes need to pay more tax, resulting in the payment of personal income tax becoming more and more popular and taxable individuals increasing. Along with that, the busy work and lack of understanding about the field of tax accounting lead to PIT taxpayers having many difficulties in carrying out.TASCO has launched the service of declaration and finalization of personal income tax to help customers remove the above worries.

24/11/2022 2503 Views

Depending on the income from the rental of houses, rooms, and apartments, there are cases of partial tax exemption, in some cases, value-added tax and personal income tax must be paid. So what is personal income tax? What is the new regulation on house rental tax under the rules of 2022? This article on TASCO will help customers better understand the above questions.

24/11/2022 1255 Views

Currently, new businesses, small and medium enterprises do not have a clear understanding of the law as well as the tax law and the periodic tax declaration in accordance with regulations. TASCO has launched a package tax declaration service to support and share worries and reduce the troubles of businesses. With a team of professional staff, highly specialized knowledge, and always updated regularly to ensure to bring customers the most perfect service quality.

![Full-Package Tax and Accounting Solutions - [Attentive Consulting - Passionate Support]](https://media.loveitopcdn.com/16184/thumb/240x240/thiet-ke-chua-co-ten.jpg?zc=1)