CIT Tax Finalization services

Company income tax finalization is the obligation and responsibility of all organizations and businesses, this is a mandatory task at the end of the financial year. What does the CIT finalization file include? When is the deadline for CIT finalization? The CIT finalization service at TASCO wants to accompany businesses in the tax finalization season.

Is your business facing the following problems:

♦ Too much workload at the end of the year?

♦ Is your company small and medium-sized, not enough human resources to perform all the tasks related to tax declaration and finalization at the end of the year?

♦ Are you a new business that has not been established for a long time, does not have a professional accounting team to undertake the accounting work?

♦ You want to have an accounting department to handle all jobs related to vouchers, bookkeeping, tax reports but still save the expense?

♦ Your company's accountant does not understand the procedures related to CIT finalization, leading to mistakes, deficiencies, and violations of the law on CIT?

✨ Don't worry, TASCO understands you, Tax Agent was founded and led by experts who are financial directors, chief accountants with more than 17 years in the field of Taxation - Finance - Accounting. Tax agent TASCO guarantees to provide you with the most effective tax and accounting solutions.

✨ With the desire to share, shoulder a part of the work, help businesses complete their bookkeeping and tax obligations as soon as possible, TASCO offers you a comprehensive solution - "Company income tax finalization".

✨ TASCO's tax finalization service will complete the tax declaration and finalization on your behalf and minimize legal risks.

WHAT THE DIFFICULTIES ARE FACED BY BUSINESSES WHEN FINALIZING TAXES?

Tax finalization is an extremely complex job, requiring accountants to have a lot of experience in a settlement. Simultaneously, you have to understand the bookkeeping and data of the business. When the tax authorities come to work, all backlogs of corporate accounting are clearly seen in a number of points such as:

✅ Invoice status, messy vouchers, deficiencies, lost vouchers.

✅ Failure to check the reasonableness, validity, and legitimacy of invoices leads to incorrect accounting, improperly.

✅Not having enough bookkeeping or having them but not according to regulations of tax authorities. Bookkeeping and reports are made without regard to the actual voucher of the business.

✅ Accounting personnel often change. The new accountant after going to work also does not have a close and complete handover with the old accountant.

✅The accounting data is not consistent, there is no logic between the accounting entries, and the tax reports and financial statements were submitted.

With tax finalization service at TASCO, we will make and submit all kinds of declarations and reports on your behalf:

⭐ Annual CIT finalization declaration

⭐ Annual PIT finalization declaration

⭐Annual financial statements include: Financial position statements, Profit and Loss Statements(P&L), Statements of cash flows, Notes To Financial Statements, Balance sheets.

⭐The declaration of associated transactions and other documents related to tax finalization.

Why should you choose the tax finalization service at TASCO?

⭕ It is carried out by a professional and experienced accounting team

⭕ Confidentiality of customer information is guaranteed

⭕ Professional, transparent, and clear working process.

⭕ Complete the work according to the commitment

⭕Advice and support for arising issues related to tax finalization services during the working process.

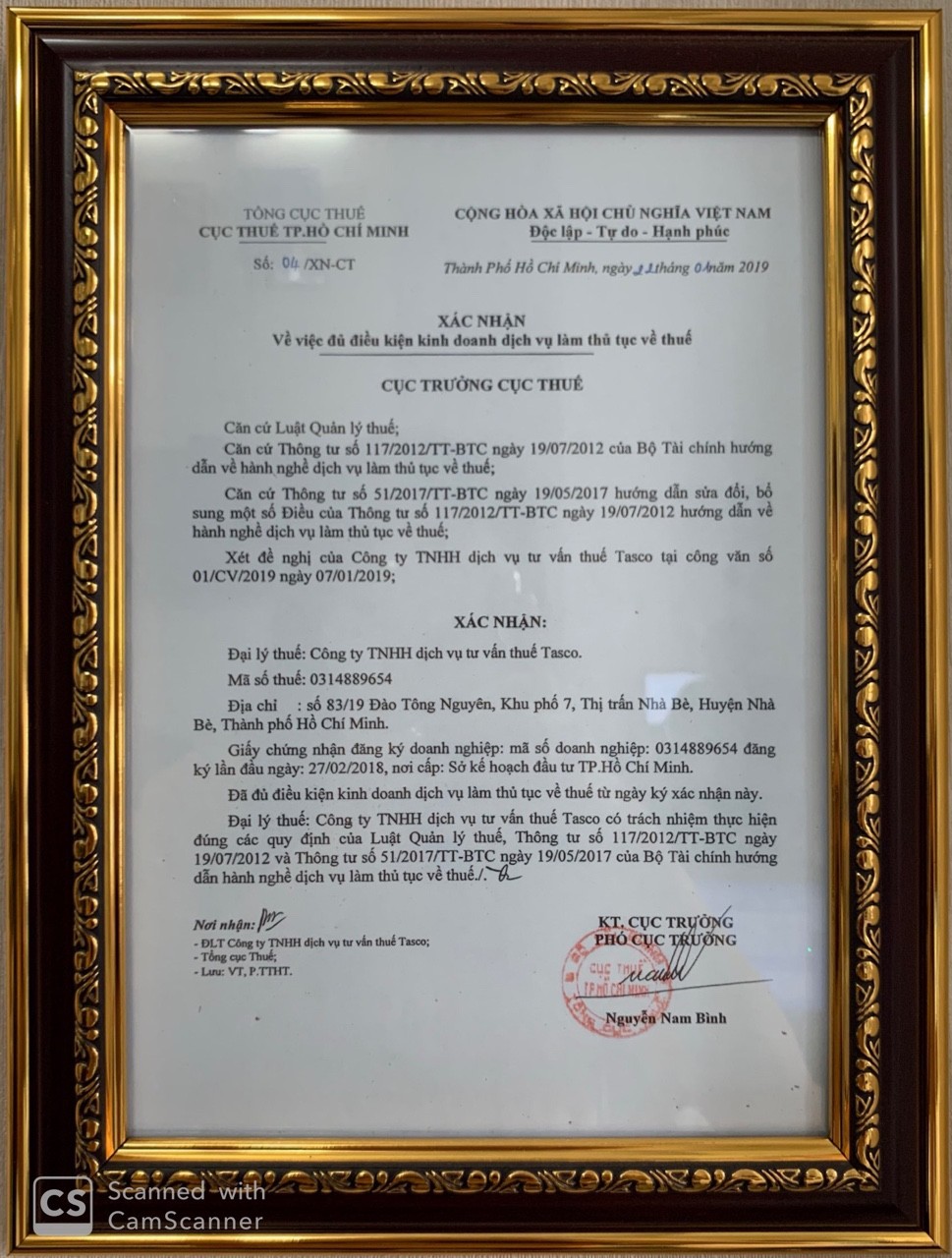

TASCO TAX AGENT SERVICE LIMITED LIABILITY COMPANY is one of the companies certified by the Tax Department of Ho Chi Minh City to be eligible to practice tax procedure services, we are committed to helping your business pass favorable tax finalization at the most reasonable cost.

WHAT IS THE DIFFERENCE BETWEEN TASCO’S TAX AGENT SERVICE AND OTHER TAX AGENTS?

1. Professional accounting team

TASCO is proud to have a well-trained team and professional accountants. Especially, the CEO has more than 17 years of experience in tax work and performing tax operations for hundreds of companies, having a certificate of tax procedures service

2. Service quality

TASCO, with the business motto "conscientious - RESPONSIBILITY - PROFESSIONAL" ensures to provide businesses with the most prestigious and professional tax accounting, consulting, declaration, and finalization services.

3. Reasonable expenses

Lump-sum expense and reasonable, customers do not have to pay any extra costs, free consultation 24/7 before, during, and after using the service.

4. Service from the heart

Tasco always puts the rights of customers first. More than anyone else, Tasco understands that customers have to invest a lot of expense when operating businesses. Therefore, Tasco always supports customers to minimize costs to operate their businesses sustainably.

SOME FREQUENTLY QUESTIONS

1. When is it necessary to submit the CIT finalization?

📌According to the regulation of paragraph 3, Article 43 of the Tax Administration Law No. 38/2019, it stipulates:

📌A tax declaration documents for a tax with an annual tax period includes:

a) The annual tax declaration file includes the annual tax return and other documents related to the determination of the payable tax amount;

b) A tax finalization declaration documents at the end of the year includes the annual tax finalization declaration, annual financial statement, and related associated transaction declaration; other documents related to tax finalization.

2. Does the company not yet have to pay CIT finalization?

Some businesses believe that if the company has not been put into operation or has not arisen, it is not necessary to submit tax finalization documents, this leads to businesses being fined for late submission of finalization declarations up to tens of millions of dong. For businesses, they are allowed to pay tax according to the declaration method, which means that they declare and pay taxes by themselves according to business results, so if the business does not submit a tax finalization declaration, the tax authority does not know whether the business has incurred or not. Therefore, if the business does not generate or operate, it still has to submit a tax finalization declaration according to the provisions of tax administration law 38/2019.

3. Is there any penalty for not submitting tax finalization documents?

According to the regulation of Article 13 of Decree 125/2020 on sanctioning of administrative violations on taxes and invoices, the following provisions are made:

📌 Article 13: Penalties for violations of tax filing deadlines

1. Warning penalty for the act of submitting tax declaration documents beyond the deadline from 01 day to 05 days and there is a mitigating situation.

2. A fine of from 2,000,000 to 5,000,000 VND shall be imposed for submitting tax declaration documents beyond the deadline from 01 days to 30 days, except for the case specified in paragraph 1 of this Article.

3. A fine ranging from 5,000,000 to 8,000,000 VND shall be imposed for submitting tax declaration documents beyond the prescribed time limit from 31 days to 60 days.

4. A fine of from 8,000,000 to 15,000,000 VND shall be imposed for one of the following acts:

a) Submitting tax declaration documents beyond the prescribed time limit from 61 days to 90 days;

b) Submitting tax declaration documents beyond the prescribed time limit by 91 days or more, but no tax payable is incurred;

c) Failing to submit tax declaration documents but not generating payable tax amounts;

d) Failing to submit the appendices according to regulations on tax administration for enterprises having related associated transactions with the enterprise income tax finalization documents.

5. A fine ranging from 15,000,000 to 25,000,000 VND shall be imposed for submitting tax declaration documents over 90 days after the deadline for submitting tax declaration documents, generating tax payable and taxpayers have paid the full amount of tax and late payment interest to the state budget before the time the tax authorities announces the decision on tax examination or tax inspection or before the tax authority makes a record on the act of late submitting tax declaration documents according to the provisions of paragraph 11 Article 143 of the Tax Administration Law.

In case the fine amount applied under this paragraph is larger than the tax amount incurred on the tax return, the maximum fine amount, in this case, is equal to the arising tax payable on the tax return but not less than the average of the fine bracket specified in paragraph 4 of this Article.

6. Remedial measures:

a) Enforce pay fully the late tax payment amount into the state budget, for violations specified in Clauses 1, 2, 3, 4, and 5 of this Article in case the taxpayer is late in submitting the tax return leads to late payment of tax

b) Enforced submission of tax declaration documents and appendices with tax declaration document for the acts specified at Points c and d, Clause 4 of this Article.

✨ TASCO tax agency with the business motto "WHOLE-HEARTED - RESPONSIBILITY - PROFESSIONAL", always ensures to bring to customers the perfect quality about financial, accounting, and tax services. More than 200 customers when using services at TASCO feel very satisfied with the service quality here. What are you waiting for, if you are in need of CIT Tax Finalization services, please contact TASCO Tax Agent immediately, we ensure to provide you the most optimal solutions for your business on tax accounting with reasonable cost and perfect service quality.

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

☎ Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

There is no news in this list