Salary over 80 million VND must pay personal income tax 35%?

When going to work and especially when receiving a high salary, many workers will pay much attention to pay personal income tax (PIT). So, if you have a salary of over 80 million VND, you have to pay PIT up to 35%?

Salary over 80 million must pay PIT how much?

🔅 For individual residents: Having a regular place of residence in Vietnam such as a rented house with a term of 183 days or more and being present in Vietnam for 183 days or more or for 12 consecutive months from the first date of arrival in Vietnam.

🔅 In order to determine how much the salary is over 80 million to pay PIT, whether it is subject to the tax rate of 35% or not, it is necessary to consider the tax rate applicable to people with a salary of over 80 million mentioned in Article 7 of Circular 111/2013/TT- BTC.

🔅 In it, consider two cases:

Case 01: The employee signs a labor contract of 3 months or more

In this case, the employee will calculate tax according to the formula:

Personal income tax payable = Taxable income x Tax rate

In there:

✔️ Taxable income is the total salary received by the employee minus the deductions: Family circumstance deduction for taxpayers and family circumstance deduction for each dependent, insurance contributions, retirement fund, a donation to charity, study promotion, humanitarian...

✔️ The tax rate that the employee must bear is calculated corresponding to the taxable income by month as follows:

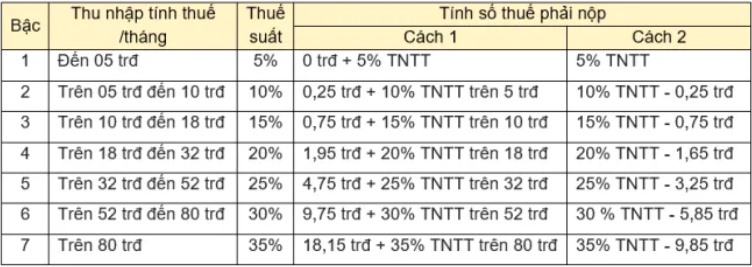

▪️ Tax rate according to the progressive method: Calculated according to each level and added together.

▪️ Tax rate according to the shortened method:

✔️ From the above analysis, it can be seen that if a person has a salary of 80 million dongs, it is unlikely that they have to pay personal income tax at the tax rate of 35%.

✔️ Because this is the actual salary this person receives without deducting insurance contributions, retirement funds, charitable and humanitarian contributions, and deductions for dependents' family circumstances.

✔️ If 80 million VND/month is taxable income (deducted deductions), then this employee has to pay personal income tax at the tax rate of 35%.

Case 2: The employee does not sign a labor contract or signs a labor contract of fewer than 3 months.

🔰 According to the provisions of Point i, Clause 1, Article 25 of Circular No. 111/2013/TT-BTC, if the employee does not sign a labor contract or signs a labor contract of fewer than 3 months, when the total income is from 02 million VND/time or more, the tax must be deducted at the rate of 10% on income.

🔰 Therefore, if this is the case, the employee is only subject to the 10% PIT rate, not calculated according to the level tax rate. That is, employees who do not sign a labor contract or sign a labor contract of fewer than 3 months are only subject to the 10% tax rate.

🔰 For non-resident individuals: Do not meet the conditions of resident individuals. This object only needs to have a taxable income higher than 0 (excluding charitable contributions, study promotion, insurance, voluntary retirement fund...) then they must pay PIT at the tax rate of 20 %.

🔰 Thus, only if the taxable income of an employee who has signed a labor contract for 3 months or more is over VND 80 million/month, they must pay the new PIT rate of 35%.

TASCO – THE HIGHEST RESPONSIBLE TAX AGENT OF EVERY SERVICE

Hotline: 0854862446 - 0975480868 (zalo)

Website: https://dailythuetasco.com or https://dichvutuvandoanhnghiep.vn

Email: lienhe.dailythuetasco@gmail.com

Address: 103/15 Nguyen Thi Thap, Tan Phu Ward, District 7, HCMC

Fanpage: https://www.facebook.com/DAILYTHUETASCO

TASCO - GIVE TRUST- GET VALUE

main.comment_read_more