Full-service accounting

Full-service accounting service for enterprises to make and manage tax accounting books according to regulations such as tax reports, accounting books, management of accounting vouchers, invoices, tax finalization, financial statements, business representatives to deal with tax issues, explain to tax authorities, ...

1. What is the full package accounting service?

The package accounting service is also known as the tax accounting service, which is the service that helps enterprises to set up and manage the system of accounting books and tax reports according to the regulations of the tax authorities. Optimize the accounting system for businesses, make accounting vouchers, make tax finalization, and professionally report financial statements, work directly with the tax authorities, explain data to tax authorities when available. inspecting, examining, consulting tax accounting policies for businesses.

2. When should I use Tasco's full accounting service?

✅ When you want to set up a business.

✅ New businesses established, little arising, want to save costs do not want to recruit accountants.

✅ Enterprises always face problems such as:

+ Tax risk: Most of the accounting units do not make monthly accounting books, leading to potential tax risks such as penalties for late submission of tax returns, resulting in the closing of the tax identification number, forced invoices, ....

Data is not secure: accountants make books in excel or cracked accounting software, data is easily changed or lost.

+ High cost of accounting personnel.

+ There is a risk of making false or losing accounting documents or accounting staff quitting their job, ...

✅ Enterprises want to have a team of consultants to help you with tax accounting regulations to minimize tax costs legally.

All of the above issues will be resolved when using Tasco's tax agent's full package accounting service.

3. What is Tasco's solution?

✅ Transparency and timeliness: Help businesses balance revenue and costs, detect and correct mistakes before it's too late.

✅ Safe, up to date: Be promptly updated with the latest tax circulars, decrees and laws.

Accounting data is processed in a timely and accurate manner, ensuring the highest benefit. Using separate misa software for each customer to ensure confidentiality and compliance with state regulations.

✅Cost savings: No need to manage an accounting apparatus, no initial expenses such as accounting software, accounting desks and chairs, printers, computers, stationery, electricity , water, travel expenses ...

4. Tasco commitments to customers:

Tasco Company is one of the companies certified by the Ho Chi Minh City Tax Department to practice tax procedures.

✅ When registering for Tasco's full accounting service, customers will be consulted free of charge all questions and procedures before and after the establishment of the business.

✅ We will explain directly to the tax authorities on behalf of the business. We always accompany our customers throughout the entire operation of the business.

5. What is outstanding about Tasco's full-service accounting service?

✅Professional and dedicated staff with more than 15 years of experience in tax accounting, chief accountant with the most economical cost.

✅Being updated, consulting current accounting and tax policies that bring practical values to businesses.

✅Consultation on human resource, labor and salary policies for businesses.

✅ Commitment to accompany, provide other consulting and support to the business during the contract implementation process.

6. Benefits received when using the service:

✅Can replace the periodic tax reports as prescribed.

✅Make accounting vouchers, accounting books, tax finalization, and financial statements according to regulations.

✅Can directly work with the tax authority on behalf of the tax authority, explain data to the tax authority when there is an inspection?

✅Free tax accounting policy advice during the service.

✅Most saving on accounting costs (you do not need to pay social insurance, no need to hire more accountants).

✅Consulted wholeheartedly, answered questions about tax whenever businesses need it by experts with deep expertise in tax accounting with many years of experience.

Discount 20% for full package accounting service for the first year, 20% off accounting software, electronic invoices for businesses using services established at TASCO.

Contact Hotline: 0975.48.08.68 or 085.486.2446 for advice.

Or email to: mylinh2883@gmail.com

website: https: //dichvutuvandoanhnghiep.vn/

or website: dailythuetasco.com

PERFORMANCE OF TASCO WHEN PROVIDE THE PACKAGE ACCOUNTING SERVICES:

Make monthly accounting books:

- Make receipts, payment slips, goods import-export notes, accounting vouchers ...

- Public diary

- Ledger of accounts

- Bank deposit book

- Detailed books such as inventory detail book, debt detail book, detailed book of fixed assets, tool detail book,

- Financial statements (balance sheet, financial position, Business results, Cash flow, notes to financial statement).

Make monthly tax reports:

- Monthly VAT report.

- Monthly PIT report.

Make quarterly tax reports:

- Quarterly VAT report.

- Quarterly PIT report.

- Report the use of quarterly invoices.

Making annual tax reports:

- Annual PIT finalization.

- Annual CIT finalization.

- Financial statements (balance sheet, financial position, business results, cash flow, notes to financial statements).

Implementation of tax registration dossiers at the beginning of each year:

- License tax return

- Registration declaration form of accounting

- Fixed asset depreciation registration sheet.

In addition, TASCO also provides the following services:

- Making statistical reports monthly, quarterly and annually.

- Directly submit tax reports and work representatives with tax authorities.

- Counseling on procedures for labor registration and social insurance, health insurance and unemployment insurance.

- Counseling on rationalizing vouchers of expenses that enterprises actually have reduced payable tax rates.

- Troubleshooting advice in accounting books.

- Consulting and answering questions about tax - accounting.

Documents provided to TASCO every month:

Every month, customers scan and email TASCO the following documents:

- Invoices and vouchers sold.

- Invoices and vouchers purchased.

- Economic contract (if any).

- Monthly salary payment sheet.

- Bank statements of the company.

- Receivable and payable situation.

- Other documents related to the company's business activities.

- Cash book money,

* Note:

- If the enterprise exports and imports goods, the additional fee is 200,000 VND / month.

- If the business has foreign elements: add 500,000 VND / month.

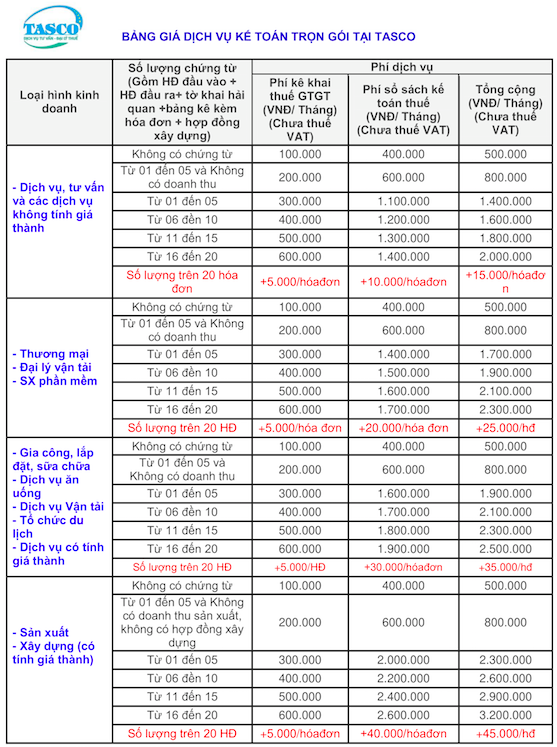

- The above price does not include 10% VAT.

- Surcharge for tax finalization is equal to the most recent service charge month.

- If customers are in districts: Cu Chi, Can Gio, the fuel surcharge will be 300,000 VND / month.

main.comment_read_more