VAT refund service [Fast] - [Professional]

VAT refund service of TASCO Tax Agent will advise and assist customers to prepare the necessary information for the preparation of VAT refund documents, on behalf of the enterprise to carry out all procedures, complete the book accounting books and preparing tax refund dossiers, submitting VAT refund dossiers to tax authorities and committing to support enterprises in explaining tax refund dossiers when inspected and examined in accordance with regulations.

Value-added tax refund is the return of VAT amount to taxpayers by the State after fully remitted into the state budget. In order to receive a value-added tax refund, a taxpayer must be eligible for a tax refund, be eligible for a refund, and have an application for tax refund.

Value-added tax refund policy has great significance for the development of businesses today, specifically:

1. Claiming tax refund and receiving VAT refund helps to create financial conditions in case business units - organizations are facing difficulties in the process of operation.

2. VAT is actually an indirect tax, so the tax refund mechanism can help businesses actively promote production activities, expand goods circulation, and increase competitiveness in the market. At the same time, it helps to create peace of mind for businesses when performing tax obligations.

3. Besides, enterprises dealing in export goods are subject to tax refund, so the value-added tax refund policy helps businesses operating in this field to boost production and increase output. goods sold abroad.

4. In particular, in order to meet the requirements of tax refund conditions, businesses need to perform accounting work clearly and transparently, so the tax refund policy has encouraged and promoted enterprises use invoices, vouchers and accounting books strictly according to the provisions of law.

It can be seen that the VAT refund policy is not only important for businesses but also has great significance for our economy today. So how to do this work properly and ensure the legitimate legal rights of taxpayers (enterprises, business organizations)? Tax agent TASCO will answer this question with a very useful solution, helping businesses maximize the cost and time of doing the job while ensuring the correctness and high efficiency:

VAT refund service (VAT) at TASCO

Currently, regulations, circulars, decrees on tax and tax accounting are always changed, supplemented, and updated regularly, so for a business that does not have a professional tax accountant, The implementation of tax procedures and documents is very difficult and can cause great risks for businesses. Coming to the VAT refund service of TASCO Tax Agent, customers will receive dedicated support and commitment to track records until receiving results.

TASCO tax agency was founded by experts who are financial directors, chief accountants with more than 15 years of experience in multinational corporations. With the mission of supporting businesses to develop sustainably and limit risks in tax and tax accounting, TASCO Tax Agent provides prestigious and professional services and acts as a bridge between businesses and tax authorities.

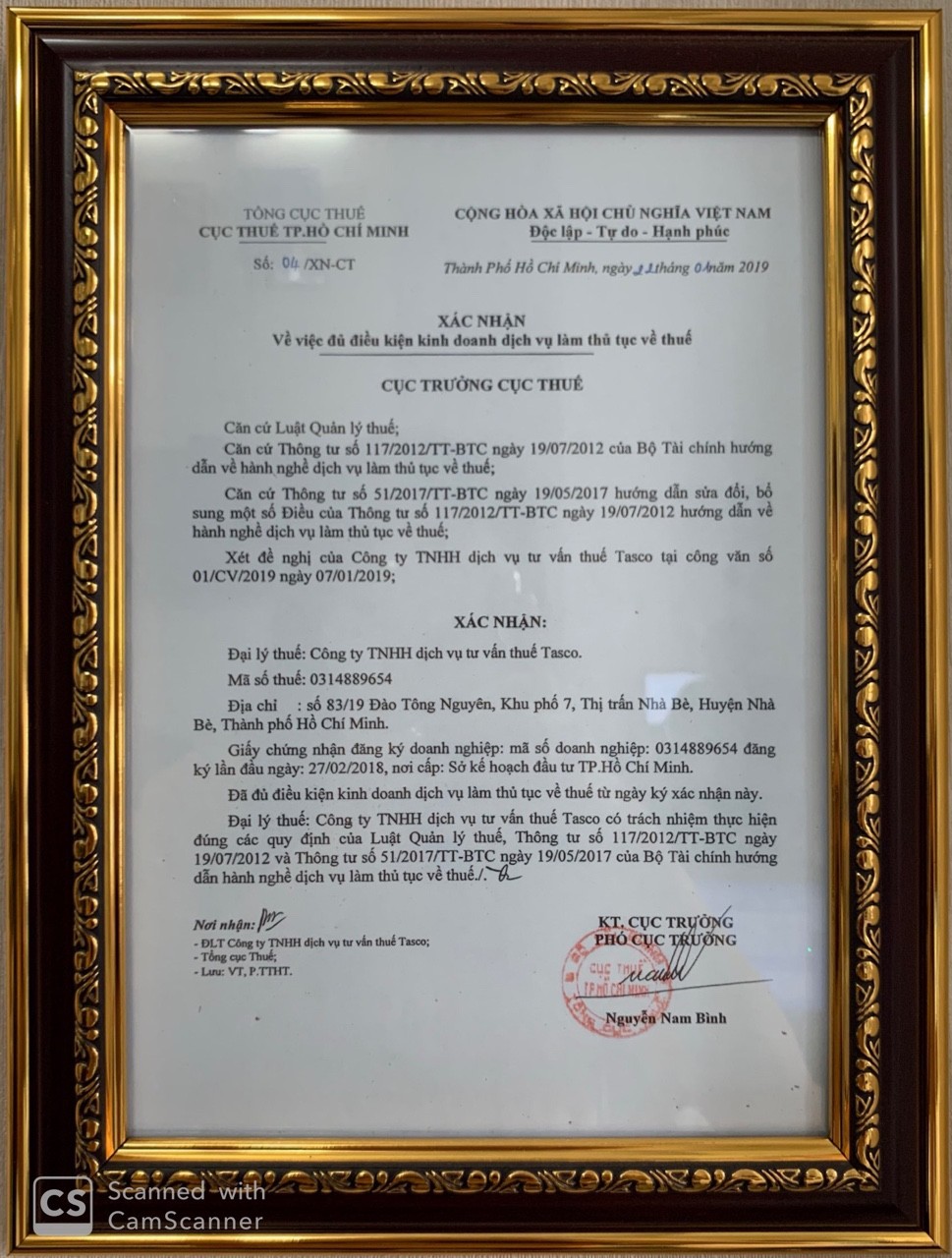

TASCO tax agents operate based on the certification of eligibility to practice tax procedure services by the Tax Department of Ho Chi Minh City, contact us immediately if you are in need of a reputable and quality VAT refund service!

With the motto "Dedication - Responsibility - Professional", TASCO Tax Agent will support customers to perform the following tasks for VAT refund service:

- Guide customers to prepare vouchers and accounting books to make tax refund documents - Consulting and guiding customers on policies related to VAT

- Prepare tax refund documents for customers

- Check and review tax refund dossiers

- Prepare tax refund application and submit it on behalf of the enterprise at the tax office

- On behalf of the enterprise, explain issues and contents related to VAT refund dossiers

- Monitor and update information of tax refund records

- Receive documents, decisions, tax refund notices at tax offices on behalf of businesses.

The process of implementing VAT refund service at TASCO

So what do we need to provide you to be able to use the VAT refund service?

This is a question that many people ask, customers only need to provide TASCO Tax Agent with the following information: Accounting documents (invoices), accounting books, tax reports, payment documents and economic contract (if it has).

Regarding the service fee, TASCO sets the service fee based on the complexity, the number of documents of the dossier and the actual completion efficiency of the service.

What is the difference between TASCO tax agents and other tax agents?

In addition to VAT refund service, TASCO also provides tax and tax accounting services, full accounting services, tax reporting and financial reporting upon the specified deadlines, consulting services for successful completion of the business. Setting up a business or changing a business license, details of these services, please refer to here:

Full tax accounting service

Tax consulting services and tax agents

Established business services

Personal income tax finalization service

Service of corporate income tax finalization

Service for changing business license

If customers have any questions about the regulations related to VAT refund or other issues, please contact TASCO Tax Agent immediately for free consultation and registration for use by the following methods:

Wish you success in business!

TASCO - THE HIGHEST RESPONSIBLE TAX AGENT OF EVERY SERVICE

Hotline: 0854862446 - 0975480868 (zalo)

Website: dailythuetasco.com

main.comment_read_more