What Procedures Should Be Followed When Adjusting, Deleting, and Repeating Exported E-Invoice?

Currently, the phrase "electronic invoice" has gradually become familiar to business travelers. In the process of using, maybe in some cases, your business will have errors in content on the issued e-invoice. So if this is the case, what should businesses do? Tax agent Tasco would like to share with you the necessary procedures when adjusting, deleting, or repeating e-invoices issued

What Procedures Should Be Followed When Adjusting, Deleting, and Repeating Exported E-Invoice?

1. Invoices have been made, not yet delivered to customers

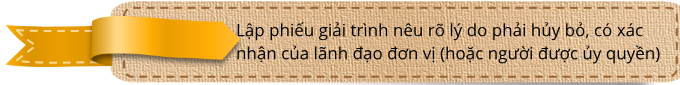

- If detecting that customer information on e-invoices is incorrectly recorded (name, tax code, address, ..) or information about the service, period and amount recorded on the invoice ... perform procedures to cancel and to repeat invoices. Procedures for canceling re-invoices of invoices are as follows:

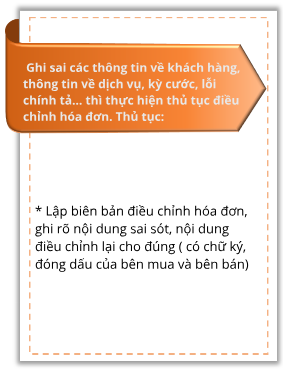

2. Invoices have been made and delivered to customers

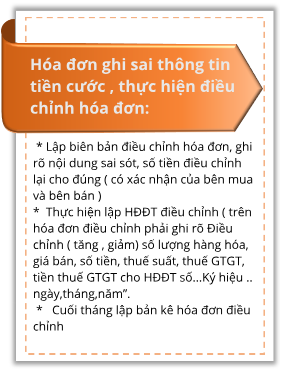

3. If detecting incorrect invoice that customer request to cancel - repeat invoice

Make a cancellation record - Re-invoice, clearly state the error content, correct content

Perform the function of canceling the e-invoice

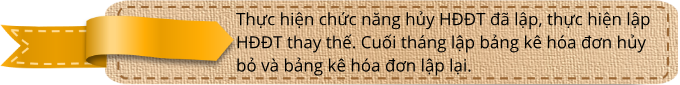

Perform the function of making replacement e-invoice (on a new invoice there must be the words "this invoice replaces the digital invoice ... symbol ..., date")

At the end of the month, make a cancellation invoice and a repeat invoice.

TASCO - THE HIGHEST RESPONSIBLE TAX AGENT FOR ALL SERVICES

main.comment_read_more