LATEST GUIDELINES FOR PIT FINISHING 2020

PIT finalization like? Profile and settlement procedures like? What are the ways that employees who receive income have PIT finalization? All the above questions will be answered by our TASCO Tax Agent to answer to customers, in addition, if you need to use the PIT finalization service, please contact the Tax Agent. TASCO now for a free consultation.

LATEST GUIDANCE ON 2020 PIT FINISHING DECLARATION

Assumption: PIT finalization at the beginning of 2020 for the income received in 2019

Legal basis:

- Article 21 of Circular No. 92/2015 / TT-BTC.

- Official Letter No. 6043 / CT-TTHT dated 18/02/2020 of Hanoi Tax Department and PIT finalization in 2019 and issuance of tax codes for dependents.

I / Subjects of PIT finalization:

Income-paying organizations and individuals (Enterprise): Make a finalization for the income that the enterprise has paid in the year.

Individuals with income (Employee): Finalizing the amount of income that they received during the year.

The relationship between the employee and the enterprise: Individuals can authorize the business to make the settlement on his / her behalf if he / she meets the conditions for authorization as prescribed.

As follows:

1. For income-paying organizations and individuals (collectively referred to as enterprises):

a) Enterprises must make PIT finalization declarations:

Enterprises that pay income from wages, regardless of whether there are withholding or not, are responsible for declaring tax finalization and settlement on behalf of authorized individuals.

(Meaning: In 2019, the enterprise that only pays income is to make a PIT finalization return in 2020. Even in 2019, there is no PIT withheld or payable -> Still have to make a PIT declaration).

b) Enterprises are not required to make PIT finalization declarations:

If in 2019, your business does not have to pay income from salaries and wages, you will not have to make a PIT finalization declaration.

If an enterprise dissolves or terminates its operation and pays income but no PIT withholding arises, the enterprise does not make PIT finalization, only provides the tax authority with a list of individuals who paid the income. imported in the year (if any) according to form No. 05 / DS-TNCN enclosed with Circular No. 92/2015 / TT-BTC no later than the 45th day from the date of the decision on dissolution or shutdown. .

2. Individuals earning income from salaries and wages (The employee receives income)

a) Employees required to make PIT finalization:

Underpayment of PIT (Required to make a PIT finalization return). Resident individuals earning incomes from salaries or wages are responsible for making tax finalization tax declaration if they have additional tax amounts.

Overpay PIT that you want to refund or offset in the next tax period. If individuals overpay PIT but want to refund or offset in the next tax period, they must make a final PIT finalization return. If an individual has overpaid PIT amount but does not want to refund or offset in the next tax period, he / she is not required to file a PIT finalization return.

* In addition, there are other cases:

+ Resident individuals earning incomes from salaries or wages are eligible for tax reduction consideration due to natural disasters, fires, accidents or dangerous diseases.

+ Resident individuals who are foreigners, who terminate their working contracts in Vietnam, must make tax finalization declaration with the tax office before leaving.

*** Individuals can make tax finalization in one of two ways:

Option 1: Do your own tax finalization with the tax authority.

Option 2: Authorize the enterprise to make the settlement instead.

a) The employees are not required to do tax finalization.

Resident individuals who have overpaid PIT amount but do not want to refund or offset tax in the next tax return period.

Resident individuals have fully paid payable PIT amounts during the year. (Neither overpaid nor underpaid)

Individuals not residing in Vietnam but having a deduction or temporary payment during the year.

3. Authorized tax finalization:

a) In case the conditions are met to authorize the settlement for:

- Individuals having only income from salaries or wages and signing labor contracts for 3 months or more at an income-paying organization and actually working at that organization at the time of authorized tax finalization In case an individual has worked for less than 12 months in a year at the organization and has a current income in other places, the monthly average of 10 million VND has been deducted 10% of the tax by the income paying unit. there is no tax finalization for this portion of income.

- An employee who is transferred from the old organization to the new one in case the old one is divided, split, amalgamated, merged or transformed.

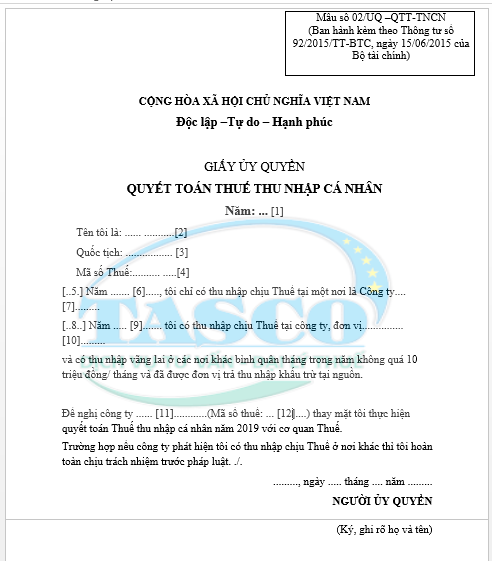

Refer to the authorization form:

In addition to the above cases, the employee must self-tax PIT with the tax office.

b) In case of ineligibility to authorize tax finalization instead

- The individual does not meet the conditions as mentioned in item 3.a above. Specifically:

+ Signing a labor contract of less than 3 months or not signing a labor contract

+ Signing a labor contract of 3 months or more at many income paying organizations

+ Actually resigned at the Enterprise at the time of authorized tax finalization. (No longer working at the business organization that wants to authorize)

+ Having current income in other places but the average monthly income of the year exceeds 10 million VND, such current income has not been fully deducted 10% by the income paying unit.

- An individual who satisfies the authorization conditions specified in Section 3.1 but has been issued with a PIT withholding voucher by an income-paying organization, shall not authorize tax finalization to the income-paying organization (except for income has been recovered and tax withholding documents canceled).

- Individual has not registered a tax code

- Resident individuals earning income from salary or wages and are also eligible for tax reduction due to natural disaster, fire, accident or fatal disease do not authorize tax finalization, but they themselves make tax finalization together. according to tax reduction consideration dossiers under Clause 1, Article 46 of the Finance Ministry's Circular No. 156/2013 / TT-BTC dated November 6, 2013.

II / Deadline for submission of PIT finalization declarations:

* Deadline for filing tax finalization is the 90th day from the end of the calendar year.

III / How to calculate the finalization of PIT in 2020 for the income paid in 2019:

- PIT payable for the whole year = (Average taxable income in month X Tax rate according to the progressive rate schedule) X 12 months.

Inside:

Average monthly taxable income = (Total taxable income - Total deductions) / 12 months.

1. Taxable income is the total income from salaries and wages that an individual actually receives from January 1, 2019 to December 31, 2020.

Taxable income for the whole year = Total income received in the year - Determined amounts of tax exemption in the year.

2. Deductions

Deductions to be deducted from the individual's taxable income before determining taxable income from salaries and wages comply with Article 9 of Circular No. 111/2013 / TT-BTC and Article 15 of Circular. Circular No. 92/2015 / TT-BTC.

See also: Circular 111/2013 / TT-BT

Circular 92/2015 / TT-BTC

Related article: The latest deductions for PIT calculation 2020

3. Note:

- The calculation above applies only to individuals who have authorization to make the settlement

- Individuals who do not authorize the finalization or are ineligible to authorize the settlement, the payable PIT amount is the PIT amount that the enterprise has deducted.

VI / PIT finalization documents:

Circular No. 92/2015 / TT-BTC changed all forms of PIT finalization from wages and salaries. So which forms are used to finalize PIT?

1. For business organizations when submitting PIT finalization dossiers:

- Form No. 05 / QTT-TNCN: The PIT finalization return replaces the form 05 / KK-TNCN enclosed with Circular 156/2013 / TT-BTC.

- Form No. 05-1 / BK-QTT-TNCN: Appendix of a detailed list of individuals subject to tax calculation according to the partially progressive table, replacing form 05-1 / BK-TNCN enclosed with Circular 156/2013 / TT-BTC.

- Form No. 05-2 / 2013 / QTT-TNCN: Appendix of detailed list of individuals subject to partial tax calculation, replaces form 05-2 / BK-TNCN issued together with Circular 156/2013 /. TT-BTC.

- Form No. 05-3 / BK-QTT-TNCN: Appendix of detailed list of dependents to reduce ornamental thorns, replacing form 05-3 / BK-TNCN issued together with Circular 156/2013 / TT-BTC.

2. For individuals making tax self-finalization using the following forms:

- 02 / QTT-TNCN: PIT finalization return instead of PIT finalization declaration form No. 09 / QTT-TNCN enclosed with Circular 156/2013 / TT-BTC.

- 02-1 / BK-QTT-TNCN: List of family allowances for dependents.

- 02 / DK-NPT-TNCN: Registration of dependents for family allowances.

- 02 / TB-MST-NPT: Notice of MST of dependents.

V / Place for submitting the PIT finalization declaration:

- Income-paying organizations and individuals being production and / or business establishments shall submit tax declaration dossiers at agencies directly managing them.

- For individuals making tax self-finalization:

+ Individuals who have calculated family allowances for themselves at the income paying organization or individual shall submit the tax finalization dossier to the tax office directly managing the income-paying organization or individual.

+ Individuals who change the workplace during the year and at the organization or individual paying the final income with family circumstances deduction for themselves shall submit the tax finalization dossier at the tax agency managing the organization or individual. pay final income.

+ Individuals who change the workplace during the year and at the organization or individual paying the final income without deduction of family circumstances for themselves shall submit the tax finalization dossier at the Tax Sub-Department where the individual resides.

+ In case the individual has not yet calculated the family deduction for himself in any income-paying organization or individual, he / she shall submit the tax finalization dossier at the Tax Department where he / she resides.

The above information is essential for individuals receiving income and business organizations paying income in 1 year. TASCO tax agent also provides PIT finalization services for customers. If you have a need to use the service, please contact TASCO Tax Agent for a free consultation and provide customers with the best quality services.

TASCO TAX AGENCY - THE HIGHEST RESPONSIBILITY FOR ALL SERVICES

Hotline: 0854862446 - 0975480868 (zalo)

Website: dailythuetasco.com or dichvutuvandoanhnghiep.vn

Email: cskh.dailythuetasco@gmail.com

main.comment_read_more