THINGS TO KNOW ABOUT E-Billing WITH TAX AUTHENTIC CODE

"From November 1, 2020, enterprises, economic organizations, other organizations, business households and individuals must register for the application of e-invoices under the guidance in this Circular". It is a quote in Circular 98/2019 / TT-BTC (guiding the implementation of Decree 68/2018 / ND-CP) and there is only more than 5 months left for all businesses across the country to comply with regulations. this.It is very necessary to find out information and convert to using electronic invoices

"From November 1, 2020, enterprises, economic organizations, other organizations, business households and individuals must register for the application of e-invoices under the guidance in this Circular". It is a quote in Circular 98/2019 / TT-BTC (guiding the implementation of Decree 68/2018 / ND-CP) and there is only more than 5 months left for all businesses across the country to comply with regulations. this.

Thus, it is very necessary to find out information and convert to using electronic invoices during this time.

Currently, there are 2 types of electronic invoices in circulation: electronic invoices with authentication codes and electronic invoices without authentication codes.

Both types of e-invoices have the function of recording information about selling goods, providing services, creating, exchanging, storing and preserving by electronic means. However, there are a few differences between them:

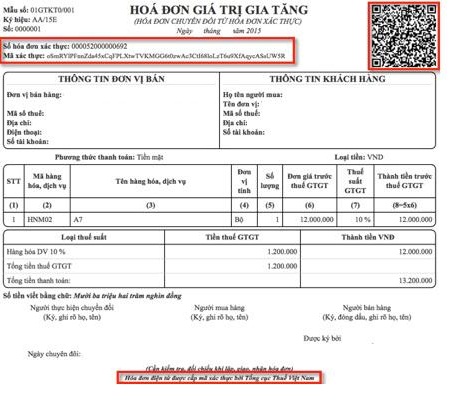

👉 First and foremost, the most noticeable thing is that an e-invoice has an authentication code with an authentication code, an authenticated invoice number, and a QR code issued by the system of the General Department of Taxation and no invoice without verification code.

👉 Second, an e-invoice with an authentication code can look up the content of each invoice and enterprises do not need to report the use of invoices, while e-invoices can only look up invoices. Invoices issued in any period and the number of invoices issued in the period, enterprises must also make a report on the use of invoices in each period.

👉Third, e-invoices with authentication codes are much more secure. To check the information of invoices, users must have a separate account issued by the tax authorities.

👉 Fourth, the invoicing process has different authentication codes and no codes.

Invoicing with the tax authority's authentication code:

Step 1: Make invoices for selling goods and providing services

Step 2: Digitally and digitally sign the invoices already

Step 3:

If the enterprise uses the invoice to access the web portal of General Department of Taxation to make invoices, then send the invoice via the portal to the tax authority to issue the code.

If using an invoice through an e-invoice service provider, send the invoice through a service provider to the tax authority to issue the code.

Invoicing without authentication code of tax authorities:

Enterprises use electronic invoicing software to make e-invoices when selling goods, providing services, digitally signing e-invoices and sending them to buyers according to the agreement between the seller and the buyer.

HOW DOES THE ENTERPRISE ARE PERMITTED TO USE E-BILLING WITH TAX CODE ?

Conditions for enterprises to register to use e-invoices with tax authorities' codes:

- Being a business that has been granted a tax code and is operating.

- Have digital certificates as prescribed by law. The deed must contain information on the tax code of the business and be valid.

- Activities in areas with the ability to access and use the internet.

Procedures for registration to use e-invoices with codes of tax authorities are specified in Article 14 of Decree 119/2018 / ND-CP as follows:

Step 1: The enterprise can access the web portal of General Department of Taxation to register to use electronic invoices with the code of the tax authority.

Registration information contents are made according to the Form No. 01 of the Appendix enclosed herewith.

Step 2: Receive a notice of acceptance or disapproval of e-invoice registration with the tax authority's code according to Form No. 02 of the Appendix enclosed herewith after 1 working day from the date of receipt. registered to use electronic invoices.

NOTE:

- From the time of using e-invoices with the tax authority's code, enterprises must destroy unused paper invoices (if any) according to regulations.

- In case there is any change in registration information for use of e-invoices, the enterprise shall change the information and send it to the tax authority according to the Form No. 01 attached to the Appendix.

Steps to announce e-invoice issuance:

Step 1: Make Invoice Issuance Notice on the Voice mailbox software

Step 2: Submit Invoice Issuance Notices and decide to use e-invoices and sample invoices to the Tax Authority via the Portal

Step 3: Check the tax authority's approval of the invoice issuance notice.

Note: Enterprises are only allowed to issue invoices with the approval of the tax authorities

Access the website tracuuhoadon.gdt.gov.vn to look up the bill compliance status of businesses.

Tax agent Tasco we provide e-invoice solutions with the business motto "RECOMMENDATION - RESPONSIBILITY - PROFESSIONALISM" to provide customers with the most prestigious and professional service.

Celebrate Uncle Ho's birthday May 19, discount up to 20% for 20 customers who register to purchase e-invoices before May 19

Immediately access website dailythuetasco.com

Or Contact Hotline: 0975.48.08.68 or 085.486.2446

Or email to: mylinh2883@gmail.com for advice and enjoy the most preferential price.

main.comment_read_more