E-INVOICES SUPPLY SERVICES

📌 When are businesses required to switch to using electronic invoices?

📌 In which circular and decree are e-invoices regulated?

📌 What are the necessary contents of an e-invoice?

📌 Do electronic invoices have good security?

⭐ Most businesses when starting to switch to using electronic invoices have the same questions. To answer, TASCO provides customers with information related to e-invoices and provides a perfect solution for customers: "E-INVOICES SUPPLY SERVICES"

✨ What is an electronic invoice?

- E-invoice is a collection of electronic data messages about the sale of goods and provision of services, created, made, sent, received, stored, and managed by electronic means, without needing to be printed, which is a perfect solution in the technology era that helps organizations and businesses to issue, distribute, handle and store electronic invoices instead issue and use of paper invoices.

✨ When is it obliged for businesses to switch from paper invoices to using electronic invoices?

- According to Circular 68/2019/TT-BTC, guiding Decree 119/2018/ND-CP on e-invoices: Compulsory business organizations to use e-invoices applied from November 1, 2020.

✨ What content e-invoices must meet?

a) Name of the invoice, invoice symbol, a symbol of the model number of invoice, invoice number; comply with the provisions of Appendix 1 to Circular No. 153/2010/TT-BTC of the Ministry of Finance;

b) Name, address, tax identification number of the seller;

c) Name, address, tax identification number of the buyer;

d) Name of goods or services; a unit of calculation, quantity and unit price of goods and services; money in numbers and words. For value-added invoices, in addition to the unit price line without VAT, there must be a line of the VAT rate, VAT amount, and total payable amount, written in numbers and words.

e) Electronic signature as prescribed by the law of the seller; date, month, year of making and sending invoices. Electronic signature in accordance with the law of the buyer in case the buyer is an accounting unit.

f) Invoices are shown in Vietnamese. In case it is necessary to write more foreign words, the foreign words shall be placed on the right side in parentheses or right below the Vietnamese line and be smaller in size than the Vietnamese letters.

✨Benefits of applying e-invoices and benefits of using e-invoice services at TASCO:

1. Save time and costs:

- No need to print invoices, save printing paper.

- No need to waste time invoicing.

- The cost for one e-invoice is much cheaper than the cost of printing one printed invoice.

- No waste time and cost for shipping invoices to customers like paper invoices. Just send it via email or through the portal very quickly and conveniently.

- Store invoices by electronic means at a much smaller cost than storing paper invoices.

- No fear of losing, rotten, torn, wet, burnt, or fake invoices.

2. Easy to manage and use:

- Convenient accounting, data reconciliation;

- No lost or damaged invoices such as rotten, torn, wet, burnt, or fake invoices.

- Simplify tax finalization and make a report on the company's use of invoices;

- Can be easily converted to paper invoices according to customer requirements in case some customers are not familiar with electronic forms.

- Convenient for inspection by tax management units.

3. Convenience in using electronic invoices:

- Issue quickly and easily anywhere if it has an internet connection or can use an integrated automatic accounting software system, in large scale;

- Ease for storage;

- Manage, statistics, search invoices easier

4. Security assurance:

- Because it is created, managed, and stored on the software system, it can be extracted directly on the software, e-invoices have high security and prevent fire damage.

🍁 Process of issuing e-invoices at TASCO:

- Create a sample e-invoice (can design the company logo on the e-invoice).

- Notice of issuance of e-invoices to tax authorities before use is similar to self-printed or ordered invoices. After 2 days from the date of issuance notice, enterprises can issue e-invoices to customers.

- Enterprises do not need to buy accounting software or electronic invoice creation software to be able to issue e-invoices which can be through the company that provides intermediate electronic invoice creation software to create at a very cheap cost, only 1,500 VND / invoice number.

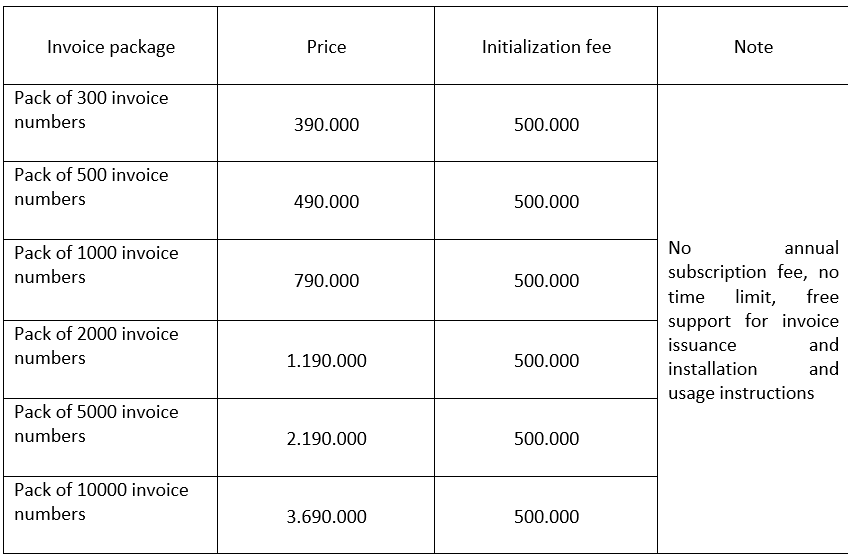

🍁 Price list of electronic invoice packages at TASCO:

⭐ TASCO Tax Consultancy Services Co., Ltd - Tax Agents is an enterprise licensed to do business in Vietnam, has a qualified enforcement team, and is trained and trained weekly on new regulations on electronic invoices and other related issues. Besides, TASCO commits not to arrise any costs in the process of using the service, only paying when the customer receives the service with the best quality.

⭐ Please contact TASCO Tax Agent in the ways below for a free consultation if you are in need of issuing electronic invoices or ordering accounting software for your business right now to take advantage of these benefits.

TASCO - Tax agent responsible for all service

TASCO - Give trust - get value

Please contact TASCO for a free consultation:

Hotline: 086.486.2446 - 0975.08.68 (zalo)

Website: dailythuetasco.com hoặc dichvutuvandoanhnghiep.vn